Why choose Mizan?

Made for mobile, built for banking. Smart. Safe. Secure. Digital.

New Account in Minutes

Opening an account with us takes just minutes, and you can set one up directly from your phone.

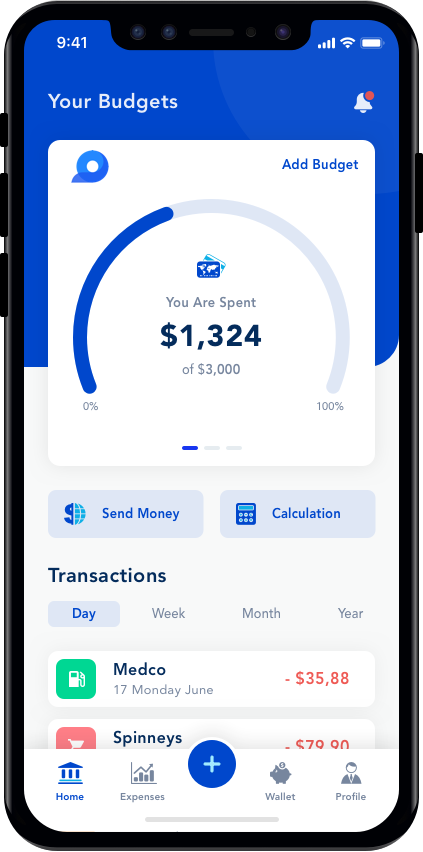

Built-In Budgeting

We’ll show you exactly where your money is going each month, and even let you set up monthly budgets for things like restaurants and groceries.

No Hidden Fees

No overdraft. No minimum balance. No monthly fees. No foreign transaction fees.

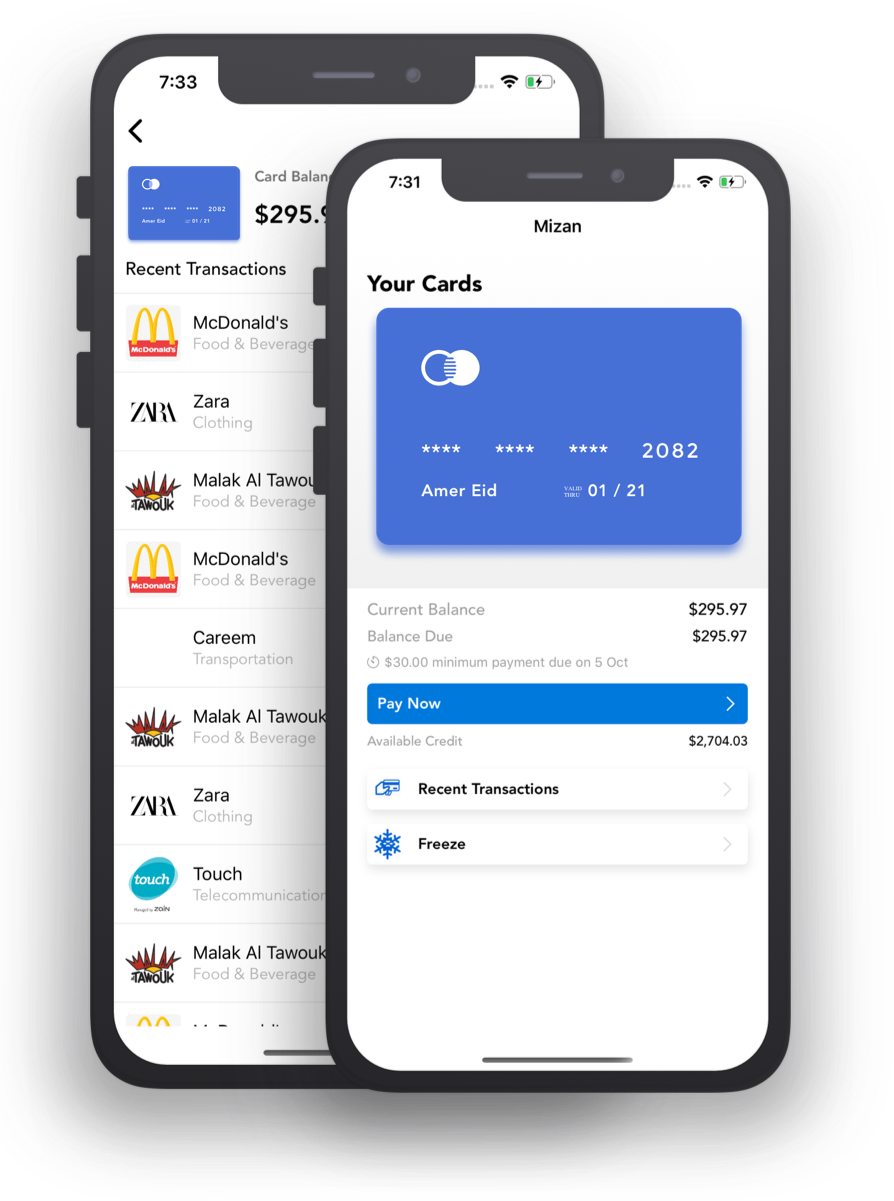

How Mizan works for you?

Here’s how Mizan is building a simple,

beautiful user-experience for the 21st century

No Branches

Everything you need is available right at your fingertips.

Privacy and protection

Mizan uses bank-level security to protect your sensitive information and prevent unauthorized use.

Friendly support

If you have any questions or run into any problems, our Mizan Customer Support team is always on hand to help you in English, French and Arabic.

Working for you

Reinventing people's relationship with money

Always know where you are with your money, track your spend, stash for specific things, pay less interest or earn more, never miss a bill. All on your phone.

Have a question?

Frequently Asked Questions.

What is Mizan?

Mizan is a startup developing simple, secure, and 100% digital solutions so you can have control over your money, literally in the palm of your hand.

Who issues the Mizan Card?

We plan to issue the Mizan card ourselves with our banking partner and are licensed by MasterCard® to issue credit cards in their network in Lebanon.

Who can open an account?

To open an account, you need to be at least 18 years of age and a Lebanese resident for tax purposes. Business, trusts and company account holders cannot open an account with us yet, only individuals.

What fees are charged for the MIzan Card?

We are against charging you to manage your own money. Since we use 100% digital channels and we cut bureaucracy and red tape to a minimum, we can pass on to you only savings, rather than costs.

Why do I need a smartphone?

We designed our products, right from the initial registration, to be as simple and secure as possible, and this is only possible by using several technological resources that only a smartphone has. For exemple, for the initial registration, we have to access your smartphone camera. Besides that, other important functionalities, such as real-time monitoring of your expenses and your credit card limit.

How does Mizan make money if it doesn’t charge fees?

Good question! With the credit card we make money two ways: When a customer makes a purchase with the credit card, the establishment where they make the purchase pays us a small percentage of the amount through the Mastercard network; and when a customer decides to pay part or all of their bill in installments, we receive interest, even if it's below market interest rates. We also profit from the interest paid in the lending operations.

Sign up for our beta rollout

We're inviting people in batches because it gives us a bit more control. You can be part of this exciting phase by signing up to the waitlist.